Surbana Jurong Capital is the investment arm of the Surbana Jurong Group. We source, plan, invest, develop and manage projects across the entire value chain of the urbanisation, industrialisation and infrastructure domains.

As the investment and asset management arm of the Surbana Jurong Group, we source, invest and manage projects across various asset classes within the urban and infrastructure domains.

Drawing on the core competencies of our technical consultants, as well as the ability to understand and manage risks associated with development-stage projects, we seek to match existing market liquidity with appropriate opportunities, generating long-term sustainable returns for our partners and clients.

Investment focus

Surbana Jurong Capital seeks to reconcile a growing demand for urban and infrastructure projects across Asia Pacific with a persistent funding gap, by investing in equity / quasi-debt instruments.

We will leverage on Surbana Jurong Group’s diverse technical capabilities to surface “bankable” projects in the greenfield and value-added brownfield space to the market and realise returns.

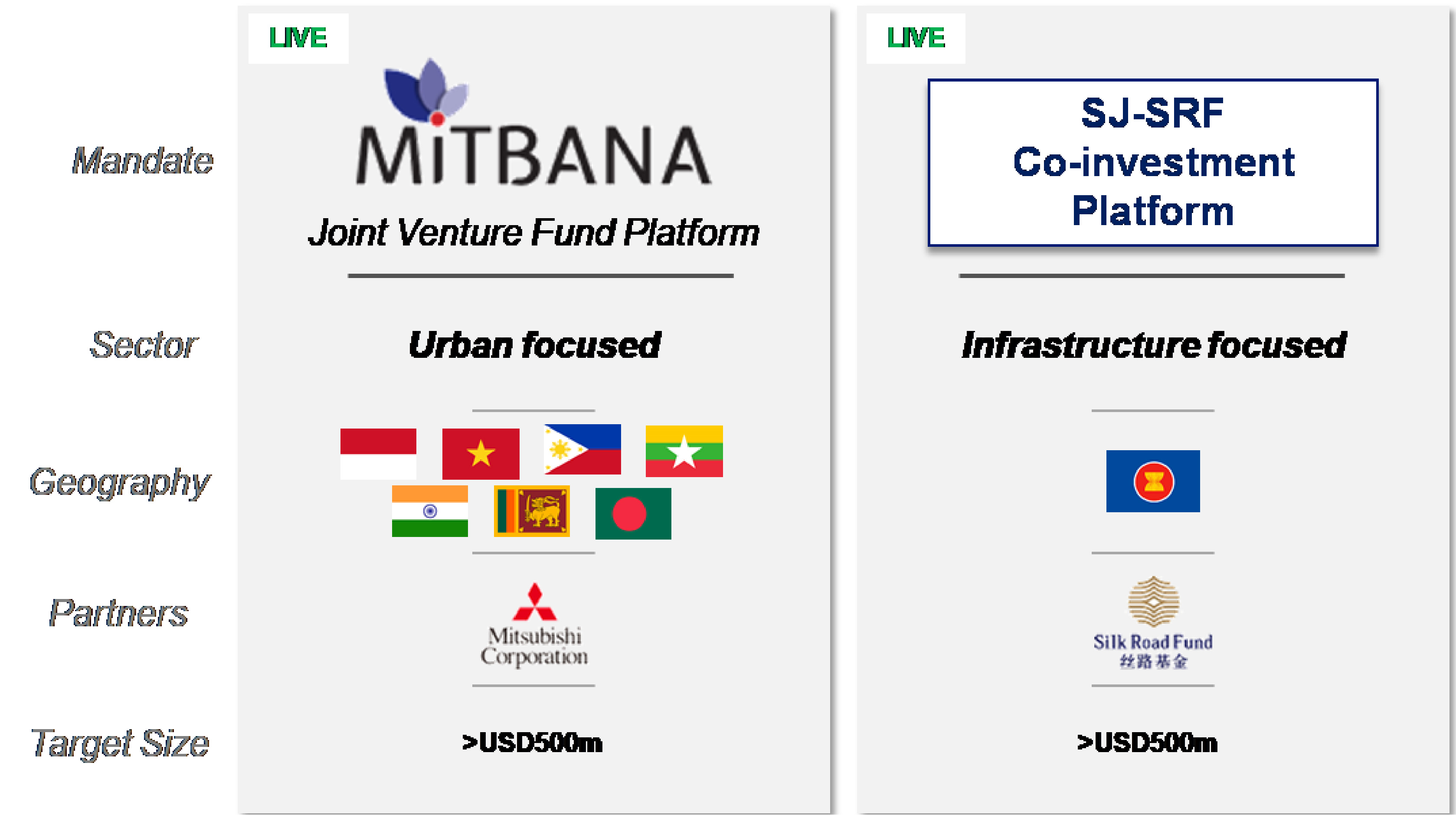

Current Mandates

Integrated approach

Surbana Jurong Group’s longstanding track record as a technical consultant, extensive network and capabilities are our key differentiating factors.

Pooling together the expertise from across the Group, Surbana Jurong Capital provides a platform to source, participate in and realise opportunities in the urban and infrastructure domains.

Building Networks

Building networks is at the heart of what we do. To this end, we focus on building long-term relationships with third party capital providers who share our investment objectives.

We also look to develop alliances with like-minded strategic partners, developers and operators who can work with us to develop and bring new opportunities to the market.

Focus on Long-term Value

We think and act long term. With a patient capital base, we focus on pursuing unique and attractive investment opportunities that can provide long-term, sustainable and risk-adjusted returns on capital.