Building A Hydrogen-Powered Ecosystem In Industrial Clusters

TAN Wooi Leong, Senior Director

TAN Wooi Leong, Senior Director

Dennis TAN Kok Meng, Director

Cliff CHUAH Khiok Eng, Deputy Director (Innovation)

Surbana Jurong – Energy & Industrial

Exec Summary

The market has recorded increased interest amongst industrialists to create or exploit decarbonisation linkages within industrial clusters or parks for mutual benefit in their journeys toward net zero carbon targets. Engineers are envisioning a new industrial ecosystem powered by hydrogen and renewable energy sources, and further complemented by energy storage system, to replace the conventional fossil fuel sources.

Overcoming the Challenge to Create H2 Industrial Symbiosis

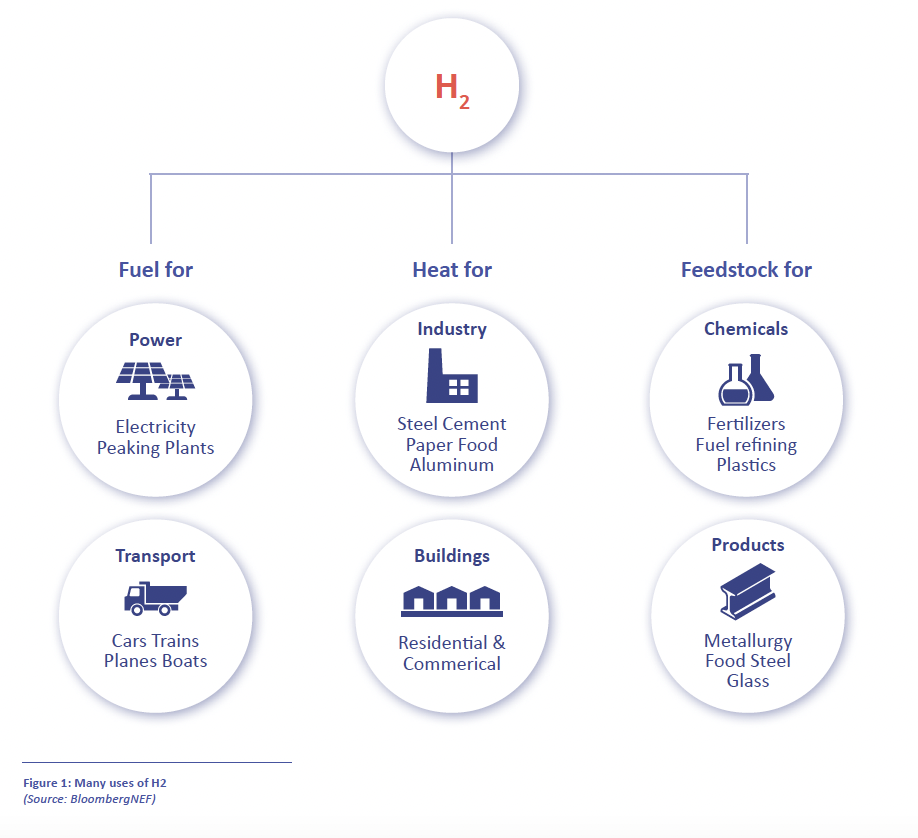

To fully decarbonize the world economy, it is likely a clean molecule will be needed, and hydrogen is well placed to play this role. It is versatile, reactive, storable, transportable, clean burning, and can be produced with low or zero emissions.

Hydrogen is a clean-burning molecule that could become a zero-carbon substitute for fossil fuels in hard-to-abate sectors of the economy. The cost of producing green hydrogen from renewables and blue hydrogen from fossil fuels with carbon capture are primed to fall, but demand needs to be created to drive down costs, and a wide range of delivery infrastructure needs to be built. That will not happen without new government targets, policies and subsidies.

This paper discusses the feasibility of various sectors transitioning to hydrogen and the factors that need to be considered in building hydrogen-powered ecosystems in industrial cluster and parks.

Industrial Clusters Lend Themselves to Hydrogen Adoption

Industrial clusters are typically massive logistical hubs, with most petrochemical hubs equipped with world-scale import jetties that import fuels and feedstocks to meet the needs of industrial energy users in the cluster and hinterland areas.

All pathways to net-zero industrial energy usage will involve hydrogen. It is therefore not surprising to see the more forward-looking industrial clusters initiating such first-mover investments. As at 2021, according to Mission Innovation, there are 31 large-scale flagship hydrogen cluster projects announced around the world. The stage is therefore set for hydrogen to play a crucial role, underpinned by 3 strategies:

(1) green hydrogen imports;

(2) deployment of electrolysers for hydrogen generation; and

(3) conversion of gas pipelines to carry hydrogen.

The co-existence of readily available excess renewables at affordable rates are a key component of an ecosystem powered or supported by local hydrogen production. Additionally, the availability of a carbon ecosystem essentially to create a larger low carbon or carbon-free manufacturing cluster to achieve better synergies.

Competitiveness is realised in industrial clusters, such as petrochemical manufacturing hubs, from the interconnectedness between industrial participants enabling economies of scale; lower interconnection costs; and ecosystem benefits. Petrochemical hubs, for example, produce and consume huge quantities of brown hydrogen – crackers generate it as a by-product; it is produced in large amounts in the form of syngas, which is then used as a reactant for further petrochemicals production; whilst integrated refinery-petrochemical complexes consume it in hydrocracking and desulphurisation processes.

GHG emissions from industrial clusters are generally accepted to be one of the hardest to abate, and therefore the adoption of clean hydrogen – a hydrogen transformation or reset lever – must be leveraged.

In the coming decades, industrial clusters, such as petrochemical hubs, will decarbonise gradually via:

(i) the reduction of fossil fuel based refinery operations;

(ii) the electrification of processes where feasible; and

(iii) where electrification is technically impractical or economically burdensome, large petrochemical units, like crackers, will be fuelled by hydrogen rather than natural gas.

We foresee that hydrogen pipeline common infrastructure will eventually be developed in mature industrial parks that play host to a diverse variety of heavy industries. This will primarily be led by private-sector consortiums and funded by local governments. Such pipeline infrastructure could run along pipeline corridors within the park, and ultimately even link up parks across single landmasses.

Hydrogen enriched natural gas (HENG) will also play a key role in the transition of natural gas towards 100% hydrogen fuel for power generation. The blend will enable hydrogen, albeit to a certain limited volume, to be transferred through existing natural gas pipelines.

The sources of hydrogen could be either green or blue hydrogen, or a combination, both imported and locally produced. And as such configurations take shape around the world, it would spur the creation of new supply chain routes and infrastructure for hydrogen transportation by sea. New ultra cryogenic vessels would be required to transport hydrogen in liquefied form (known as LH2) at -253 degC. Hydrogen can also be transported via other energy carriers such as ammonia, liquid organic hydrogen carriers (also known as LOHC) or methyl cyclohexane (also known as MCH).

The various new clean energy sources, supply chains and infrastructure for hydrogen would spur new ecosystems to be formulated within the industrial clusters, hence creating an energy revolution that is not seen since the industrial revolution.

Carbon Pricing is Key for Sectors to Pivot to H2 Adoption

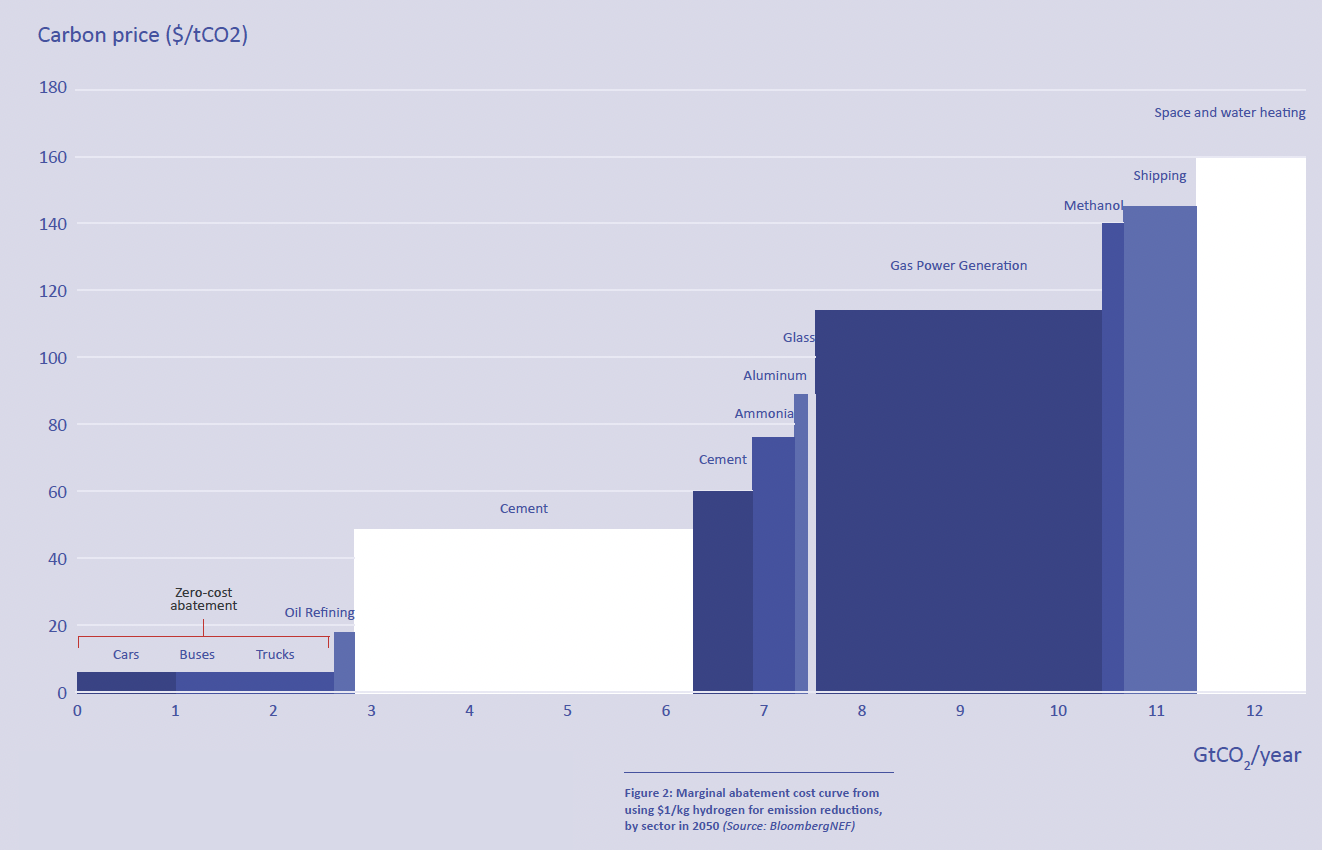

Even at $1 per kg of hydrogen ($7.4/MMBtu), carbon prices or equivalent measures that place a value on emission reductions are still likely to be needed for hydrogen to compete with cheap fossil fuels in hard-to-abate sectors (Figure 2). This is because hydrogen must be manufactured, whereas natural gas, coal and oil need only to be extracted, so it is likely always to be a more expensive form of energy. Hydrogen’s lower energy density also makes it more expensive to handle.

Figure 2: Marginal abatement cost curve from using $1/kg hydrogen for emission reductions, by sector in 2050 (Source: Bloomberg NEF)

H2 Role in Transportation Sector

Global transportation generates 24 percent of global direct CO2 emissions from gasoline and diesel combustion processes today, with road vehicles like cars, trucks, buses, and motorcycles contributing roughly three-quarters of global transportation emissions. Battery electric vehicles (BEVs) and fuel cell electric vehicles (FCEVs) are both viable alternatives to decarbonize global transport. Use case-specific requirements such as range, payload and power requirements can determine the applicability and competitiveness of battery- or hydrogen-powered solutions.

Hydrogen can play a valuable role decarbonizing long-haul, heavy-payload trucks. By 2031, these could be cheaper to run using hydrogen fuel cells compared to diesel engines. But the bulk of the car, bus and light-truck market looks set to adopt battery electric drive trains, which are a cheaper solution to fuel cells.

Major investment is also required to build associated Infrastructure to generate, store and transmit hydrogen in either gaseous or liquid form, or its energy carriers. The cost of these new- build infrastructure is presently significantly higher than conventional process related infrastructure. In addition, stringent safety considerations and operational requirements further inflate the total investment cost for hydrogen infrastructure.

H2’s Role in Hard-to-Abate Sectors

The strongest use cases for hydrogen are the manufacturing processes that require the physical and chemical properties of molecule fuels in order to work. Hydrogen can enable a switch away from fossil fuels in many of these applications at surprisingly low carbon prices. For example, at a hydrogen price of $1 per kg, a carbon price of $50/tCO2 would be enough to switch to renewable hydrogen in steel making, $60/tCO2 to use renewable hydrogen for heat in cement production, and $90/tCO2 for aluminium and glass manufacturing.

H2 Role in Ammonia Sectors

Ammonia is produced via the Haber-Bosch process, which combines hydrogen and nitrogen. As a highly feedstock-intensive process, a significant share of ammonia’s carbon emissions result from the carbon intensity of the feedstock (30-40% of cradle-to-plant-gate greenhouse gas (GHG) emissions per ton of ammonia). Consequently, apart from using green electricity as an input for the conversion process, the only option for decarbonizing ammonia production involves the substitution of grey hydrogen from natural gas with renewable or low-carbon hydrogen. For example, at $1/kg of hydrogen, a carbon price of $78/tCO2 would be enough to switch to renewable hydrogen in ammonia making. It is noteworthy that ammonia storage and handling processes are already well established.

H2 Role in Refinery Sector

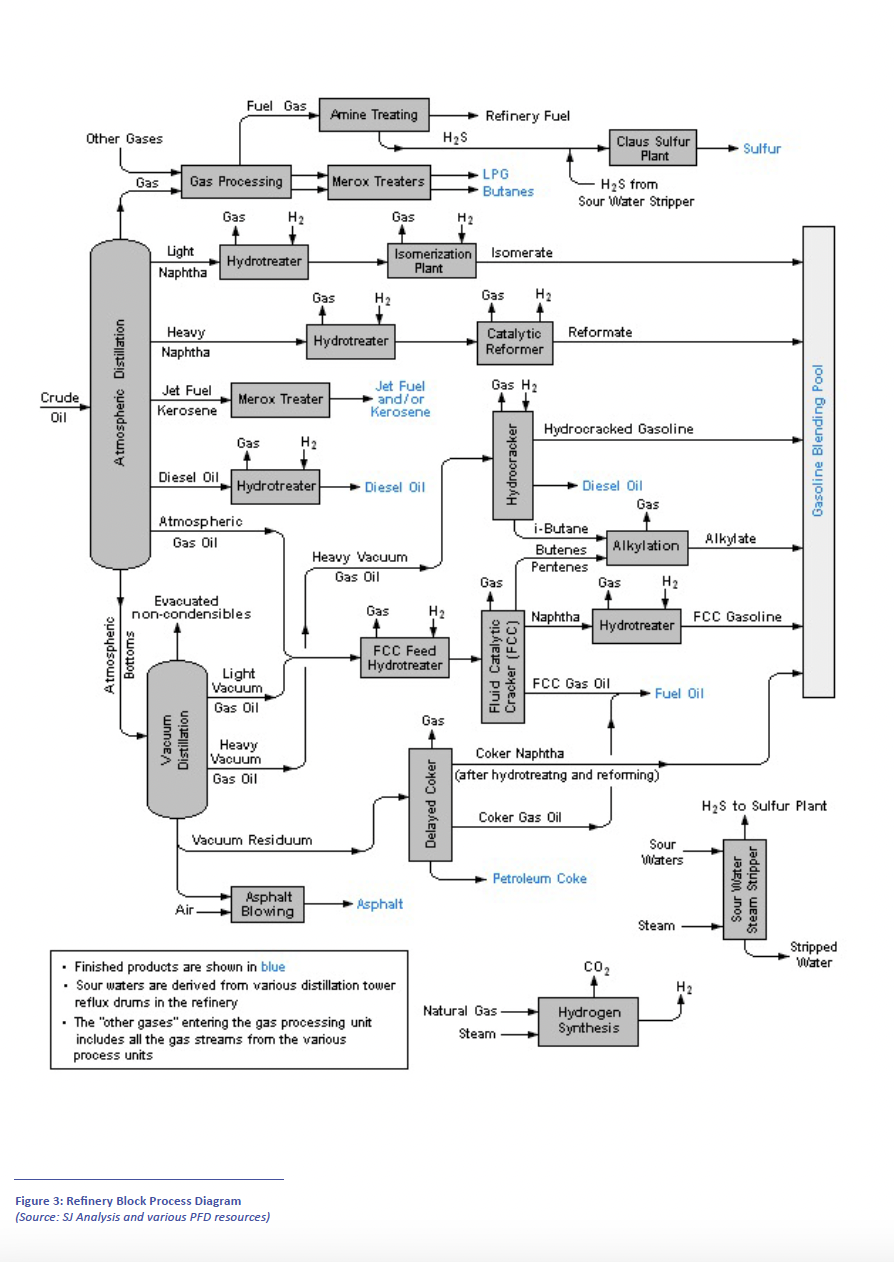

Figure 3: Refinery Block Process Diagram (Source: Wikipedia)

Hydrogen is mainly used to process crude oil into refined products and for desulphurisation, with different products allowing different levels of sulphur, based on regulations and industry requirements. The lower the sulphur content requirement, the higher the demand for hydrogen. Global and industry focused policies had required lower amounts of sulphur in transportation fuels, and this is driving increased demand for hydrogen in this sector.

Previously, naphtha was the main fuel being used to produce hydrogen via on-site catalytic reformation, which supplied the need of hydrotreating and hydrocracking processes. Over time, this was replaced with natural gas reformation due to the increased demand for naphtha to produce petrochemicals at refineries to maximize profit. Apart from the SMR’s high-emissions H2 production, as depicted in Figure 3, hydrogen is required for hydrotreating, hydrocracking and isomerization facilities in a typical refinery plant, presenting huge opportunity to lower emissions with green or low carbon hydrogen in the refinery sector.

Steel, Aluminium and Glass Manufacturing:

These present the strongest use cases for a switch from fossil fuels at surprisingly low carbon prices. At $1 per kg of hydrogen, a carbon price of $50/tCO2 would be enough to switch to renewable hydrogen in steel making; $60/tCO2 to use renewable hydrogen for heat in cement production; $78/tCO2 for ammonia synthesis; and $90/tCO2 for aluminium and glass manufacturing.

Infrastructure Investment: Infrastructure to generate, store and transmit hydrogen in either gaseous or liquid form, or its energy carriers is now significantly higher than conventional process-related infrastructure. In addition, stringent safety considerations and operational requirements further inflate the total investment cost for hydrogen infrastructure.

Ammonia:

Ammonia storage and handling processes are already well established. As a highly feedstock-intensive process, a significant share of ammonia’s carbon emissions result from the carbon intensity of the feedstock (30-40% of cradle-to-plant-gate greenhouse gas (GHG) emissions per ton of ammonia). Consequently, apart from using green electricity as an input for the conversion process, the only option for decarbonizing ammonia production involves the substitution of grey hydrogen from natural gas with renewable or low-carbon hydrogen.

Based on some future industry demand and marginal abatement cost projections, the industry cluster mix for the low-carbon H2-driven industrial park could comprise the following sectors:

- Transportation (mid to heavy duty)

- Chemicals & Petrochemicals

- Power

- Heavy metals – Iron and steel

- Cement

- Fertilizer/ Urea

There may also be new sectors involving clean energy, new materials, biomedical and life sciences that could potentially add symbiotic elements to the hydrogen equation.

Connect with Us

Tan Wooi Leong

Email: [email protected]

Dennis Tan Kok Meng

Email: [email protected]

Cliff Chuah Khiok Eng

Email: [email protected]