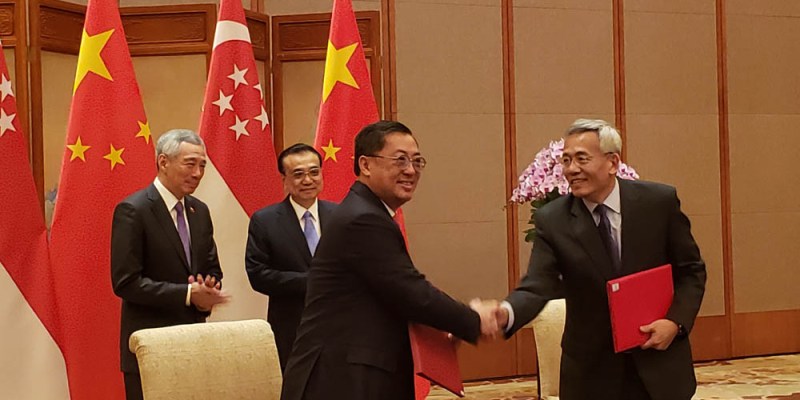

Mr Wong Heang Fine, Group CEO of Surbana Jurong (front row, left) and Mr Wang Yanzhi, President of Silk Road Fund, sharing a handshake after the partnership signing as Singapore Prime Minister Lee Hsien Loong (back row, left) and Chinese Premier Li Keqiang look on.

Surbana Jurong entered into an agreement with China’s Silk Road Fund on 29 April 2019 to set up the China-Singapore Co-Investment Platform, to invest primarily in greenfield infrastructure projects in Southeast Asia.

The partners expect to invest about US$500 million over the next few years, with each partner investing in principle equal amounts in the projects. Investments of the platform could take various forms, including equity and debt.

Silk Road Fund is a medium- to long-term investment fund dedicated to support the Belt and Road Initiative (BRI). The partnership was initiated and facilitated by Infrastructure Asia, a regional infrastructure project facilitation office under the Singapore government. It brought Surbana Jurong and Silk Road Fund together due to their complementary capabilities and common intent of investing in Southeast Asia.

Surbana Jurong, which will invest through its investment arm Surbana Jurong Capital, will leverage its familiarity with local markets through its offices in BRI countries and recommend projects to the Platform, and both partners will jointly assess the investment viability of the projects. The Platform is well-positioned to tap BRI-related opportunities and promote infrastructure development and connectivity, thus contributing to the sustainable economic and social growth of communities across BRI countries.

The agreement was one of five signed between Singapore and China in April 2019 in the areas of business, customs enforcement and infrastructure investment, as part of collaborative efforts between the two countries under the Belt and Road Initiative.

The China-Singapore Co-Investment Platform and four memorandums of understanding (MOUs) were signed at Beijing’s Diaoyutai State Guesthouse by representatives from both countries, including Singapore’s Trade and Industry Minister Chan Chun Sing. The signings were witnessed by Singapore’s Prime Minister Lee Hsien Loong and Chinese Premier Li Keqiang.